Last week while travelling bought the book, “The Writing on the Wall: Why We Must Embrace China as a Partner or Face It as an Enemy”. Am halfway through when I bumped into a good friend and an industrialist with global ambitions – he was returning from Tiecon in KL when he said that he would never look towards investing in china as one can never take returns out. In the book, Will Hutton, the economics editor of The Guardian performs a thorough analysis of the U.S. and Chinese economic policy, sounding the alarm that "the implications could not be more profound" should Western superpowers fail to shape China into a workable model of democracy and enlightenment.

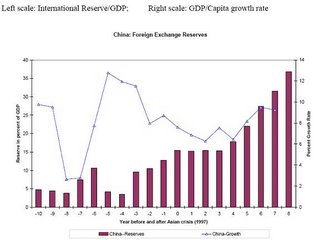

Lets look at china – Today it's characterized by a galloping forex, excessive dependence on exports and FDI(like other asian tiger economies), a high savings rate(increasing from a small base), a dull domestic consumption , horrendous misallocation of capital, rising inequalities(shenzhen, shanghai lifestyle vs rural). Many westerners/outsiders overlook the fact that corruption and a stifled private sector (around three fifth of its exports and nearly all its high tech exports are made by non-Chinese, foreign firms) make it so unique – this is unlike a Taiwan or Korea – these put limits on the extent to which the existing chinese political-economic model can be sustained. An ever supportive west tends to overlook these issues and comes with an occasional note of concern – primarily on currency valuation does not rally help the cause – the imbalances and uncertainties loom large.

Bloomberg’s William Pesek finds that China isn't likely to slide into crisis in 2007, though the number of issues that may come to a head is daunting. On the one hand, China needs to create millions of jobs to spread the benefits of rapid growth. On the other, it must slow things down to avoid overheating - something it didn't do in 2006. He points out that the china's economy isn't like others and complicates the efforts. It lacks a liquid bond market, limiting the central bank's influence. It also lacks a cohesive, national fiscal policy centered in Beijing. It's a bit like trying to control a speeding car without decent brakes or reliable steering. Add in to the mix worsening pollution and rising rural discontent. The coming year could be a watershed year.

He points out that the china's economy isn't like others and complicates the efforts. It lacks a liquid bond market, limiting the central bank's influence. It also lacks a cohesive, national fiscal policy centered in Beijing. It's a bit like trying to control a speeding car without decent brakes or reliable steering. Add in to the mix worsening pollution and rising rural discontent. The coming year could be a watershed year.

I was speaking to a very influential central banker - one point that took me by surprise - of what use is the country reserve beyond a certain level of providing import cover and a check on currency fluctuations. Just a psycological cushion? Puttting excess reserve money into the country creates excess money supply and goes against the grain of monetory supply control. A recently released IFC paper captures the economic issue at hand so succinctly. No doubt the middle nation has clocked huge growth but the moral here: Old models won't work for long - look soon for new approaches to emerge either from within or influenced by others.

Category :China, Emerging Trends, 2007 Predictions

|