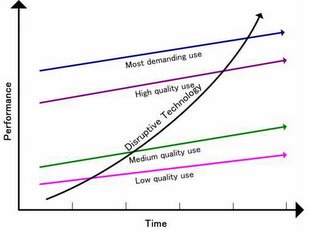

In diagnosis for disruptive technologies,I covered earlier, “disruptive innovations typically take advantage of "asymmetries of motivation" by entering markets that incumbents are motivated to exit or ignore”. Looking at a competitor's income statement, balance sheet, history of investment decisions, and customers can help identify the developments to which a company might not respond. Companies that introduce disruptive innovations also tend to create asymmetric skills - they develop the unique ability to do what their competitors are unable to do.

Jim Jubak at MSN Investing has an excellent note on how to invest in disruptive change and lists the next seven disruptive opportunities with huge impact to business & society. He is spot on when he writes, the biggest winners in technologies are the ones that change the game completely, sending rivals to the scrap heap. No truly big change takes place without overturning traditions, sending competitive rules to the dustbin of history, and destroying formerly flourishing companies. Avoid the victims and own the agents of change and you'll retire richer. Change is a good thing. Pointing out that a faster and more powerful graphics chip sends one to the store to buy a new PC … to buy new games that take advantage of the chip … to upgrade display etc ... Disruptive change creates huge problems for investors, but disruptive change also presents huge opportunities for investors. EBay and Google for example, have done pretty well by investors by rearranging the landscape for online retailing and advertising.

Listing three rules to profit from destruction – he recommends to look for companies that actually have a plan for profiting from the disruptive shift in technology. Innovation is neat, but for investors it's not nearly as important as a profitable business plan.

• Don't pay too much. Since the odds are that at least 30% of the stocks that you pick as disruptive opportunities will head south, the key is not to pay so much for them.

• Don't ignore established companies that are willing to cannibalize their existing business in order to reap the potential profits of disruption. The returns and losses out of such investments won't be as large either.

As he sees it the list of next set of disruptive technologies:

- The "Cell" microprocessor.

- The home-entertainment gateway.

- The home-entertainment hub.

- Internet telephony over mobile phones.

- Electronic, networked health-care records.

- Ubiquitous mapping

Excellent post - if only if we are able to encash on the rise of diruptive technologies as investors as well - the momentum towards spotting, funding and gaining from disruptive technologies are going to be significant, timing is equally important - right now, am betting on on demand and mature BPM players in enterprise technology space as backable winners for providing returns on ivestments.

Category :Disruptive Innovation, Investments

|