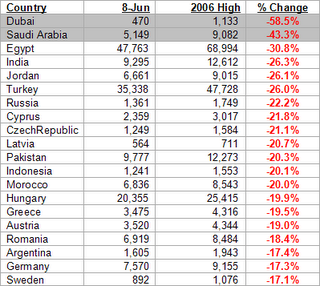

The crash of the stock marlets around the world have brought the role of central banks into sharper focus. John Mauldin offers some insightful analysis for the drop in equity markets: rising interest rates, rising inflation, and tough language from the central banks. His analysis of 64 markets aroun the world shows that all the markets in his list are off their recent highs.  Two-thirds of world markets are down 10% or more, with Middle Eastern markets in free fall for the past few months. Indeed, they seem to have been a warning sign of trouble, as they have led the way down. By contrast, the broad US markets have held up relatively well. The Dow is off around 6.4% from its high, which hardly qualifies as a decent correction, and the NASDAQ is down by 10%. He attributes the downfall to the change in major central bank policy which began a few months ago. In short, the central banks of the world are taking liquidity out of the system. It was the providing of massive amounts of liquidity that had driven asset prices around the world to frothy heights, and now it can be seen what happens when that process goes into reverse. The warning bells were always there. For the last 30 years, new Fed chairmen (Miller, Volcker, Greenspan) have felt the need to prove their mettle. And it has resulted in a lower stock market. It looks like this time will be no exception. Jim Jubak sees the simultaneous global meltdown in stock and bond markets from Bombay to New York as a vote of no confidence in the world's central bankers. Central banks everywhere are facing huge challenges. Raghuram Rajan in a recent speech to central bankers on the role of central banks in 21st century recommended that "It may well be that monetary policy is best focused on maintaining domestic price stability narrowly defined over a medium term horizon, and not on anything else".

Two-thirds of world markets are down 10% or more, with Middle Eastern markets in free fall for the past few months. Indeed, they seem to have been a warning sign of trouble, as they have led the way down. By contrast, the broad US markets have held up relatively well. The Dow is off around 6.4% from its high, which hardly qualifies as a decent correction, and the NASDAQ is down by 10%. He attributes the downfall to the change in major central bank policy which began a few months ago. In short, the central banks of the world are taking liquidity out of the system. It was the providing of massive amounts of liquidity that had driven asset prices around the world to frothy heights, and now it can be seen what happens when that process goes into reverse. The warning bells were always there. For the last 30 years, new Fed chairmen (Miller, Volcker, Greenspan) have felt the need to prove their mettle. And it has resulted in a lower stock market. It looks like this time will be no exception. Jim Jubak sees the simultaneous global meltdown in stock and bond markets from Bombay to New York as a vote of no confidence in the world's central bankers. Central banks everywhere are facing huge challenges. Raghuram Rajan in a recent speech to central bankers on the role of central banks in 21st century recommended that "It may well be that monetary policy is best focused on maintaining domestic price stability narrowly defined over a medium term horizon, and not on anything else".

Category :Markets, Central Banks

|